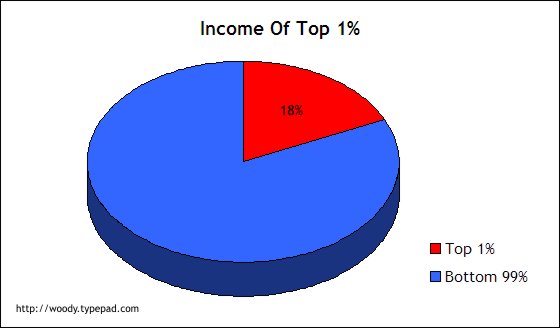

Financial Inequality & the 1% - Where Did All the Money Go?

/"It was the best of times, it was the worst of times...," wrote Charles Dickens in the 1800s. The same could be said now. Apparently for the top 1% of America it's the best of times. One of my questions since the  crash of 2008 has been "Where has all the money gone?" According to the Congressional Budget Office the top 1% of U.S. households almost tripled their after-tax income from 1979 to 2007. For us middle class folks, after-tax income grew 40% and the lower end of the economic scale increased also, but only by 18%.(Modesto Bee 10-27-11 Rich getting richer more quickly)

crash of 2008 has been "Where has all the money gone?" According to the Congressional Budget Office the top 1% of U.S. households almost tripled their after-tax income from 1979 to 2007. For us middle class folks, after-tax income grew 40% and the lower end of the economic scale increased also, but only by 18%.(Modesto Bee 10-27-11 Rich getting richer more quickly)

But let's wait a minute. Hasn't wealth in America (& the world) always been unequally distributed? Yes and let's start by looking at what the definition of 1% really consists of. First, according to Joyce Apleby, emeritus professor of history at UCLA, there's income and there's wealth. To be a one-percenter you have to earn more than $700,000 a year (income) and have assets (wealth) of more than $9 million.

Ok, now we understand the basics of 1% economics. What's the economic truth for the rest of us? Have we middle class Americans been operating from an illusion that we could become rich? Yes and no. "From 1776 to the present, the bottom 60% of the U.S. population has never had more than 11% of the country's wealth." Hmm...Of course if you've done the math this 60% doesn't account for 39% of us.

Back to the question of, "Where did all the money go?" Well, well we know the banks got a lot of money. The investment bankers and hedge fund guys that is. But, I don't really think there's a simple answer to this question. We have a dream in America that hard work, luck and opportunity opens the door to fortune. That dream is a good one because it creates HOPE and in every generation the dream becomes true for a few. This "worst of times" economic recession is a wake-up call to look at the economic inequalities that have always been present, for the 99% to to keep the hope, the hard work and to hold the 1% accountable to a financially more equitable system for all.

investment bankers and hedge fund guys that is. But, I don't really think there's a simple answer to this question. We have a dream in America that hard work, luck and opportunity opens the door to fortune. That dream is a good one because it creates HOPE and in every generation the dream becomes true for a few. This "worst of times" economic recession is a wake-up call to look at the economic inequalities that have always been present, for the 99% to to keep the hope, the hard work and to hold the 1% accountable to a financially more equitable system for all.